Fund Managers Have A House Style

Every fund manager has a “house style” that reflects their investment philosophy.

On one level some fund managers will choose to invest in equities, some in bonds, some in other asset classes. Some equity managers will prefer passive investing, others active management. Some of the active managers will target income, some value, others growth. And so on.

On another level their investment philosophy will influence what factors they think will deliver successful investments. Some of those factors might be financial metrics such as profitability, or dividend yield. Others might be factors like how long the manager is prepared to hold any investment (Are they a short-term trader? Or a long-term investor?), or how much uninvested cash they prefer to hold.

All these things add up to an individual house style that will strongly influence the fund manager’s portfolio – what they buy, how long they hold those investments for etc.

And Then There’s The Market Cycle

In parallel to this the financial market has a cycle of its own, where it progresses through bull periods and bear periods. From troughs to peaks and back to troughs again. This is driven by economic, financial and demographic effects that are outside the control of any fund manager.

The Challenge For Each Fund Manager

The challenge then for each fund manager is to develop and optimise their house style so that it delivers the best outcomes across the full market cycle.

There will be periods in that market cycle that will align with a fund manager’s “house style”, and other periods that will be a headwind to that house style. We’re not aware of any fund manager whose style is optimal at every stage in the market cycle. So each fund manager has to accept there will be times when they under-perform the market, and other times when they will out-perform it. They need to optimise their style across the whole span of the market cycle.

But when we say “best outcomes” and "under-perform" and "out-perform" we need to interpret that in light of what is the objective of the fund manager’s investment philosophy and house style. Is the fund manager optimising for the highest returns across the cycle? Or the lowest volatility? Or minimal drawdowns? Or some other metric?

Where This Matters

You will see the effect of each manager’s house style in their long-run performance. In any given period you will find some fund managers appear to do well (perhaps because it’s a time where the market cycle aligns with their house style), while others appear to do less well (perhaps because it’s a time where the market zigs while their house style zags). But that short-term variability levels out over periods of 5 years or longer, and so you get to see the inherent performance of the fund manager’s house style.

We strongly believe that each house style has an inherent long-run rate of return. You will see that inherent long-run rate of return in these 5-year (or longer) average returns [1].

Similarly, each house style has an inherent level of volatility, and maximum drawdowns, and so on. Again, you will see that inherent performance over 5-year (or longer) periods.

Lighthouse Funds' House Style

At Lighthouse Funds our investment philosophy has three parts:

- We will only invest in highly profitable, conservatively run companies whose shares have deep liquidity, and

- We believe that within that universe there will always be a small set of companies who have strong medium-term growth, and

- We need to be patient investors to allow that medium-term growth to come to pass.

This investment philosophy and house style is consciously optimised for achieving strong net returns.

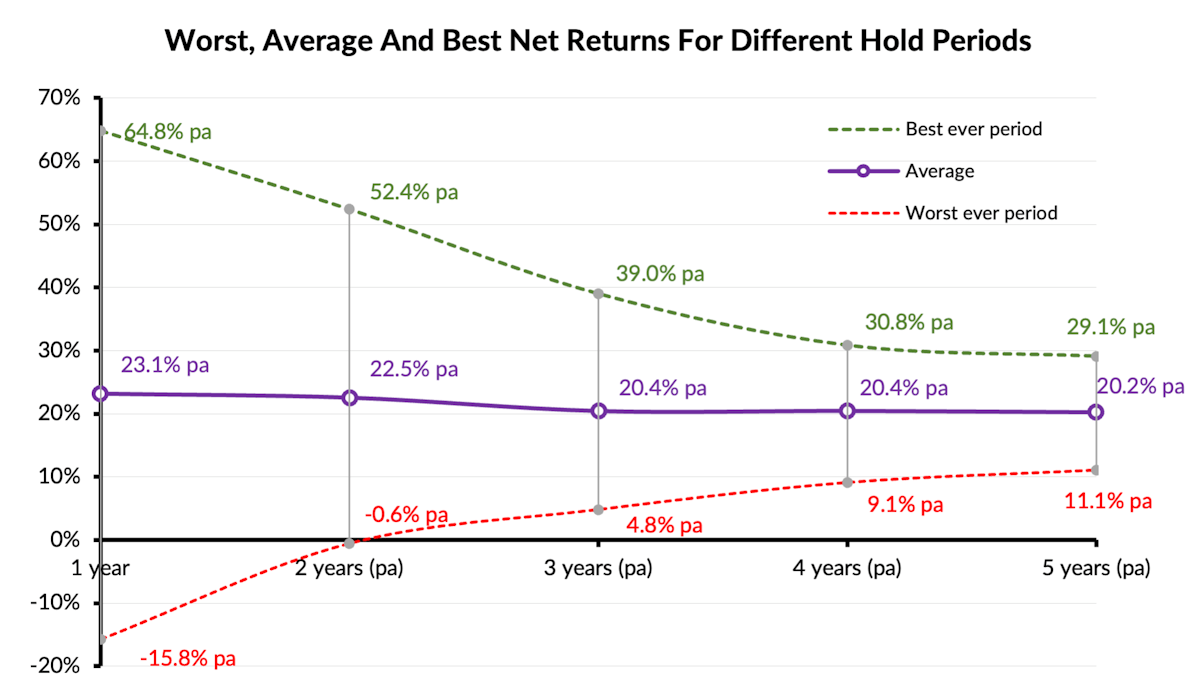

We believe the inherent long-run rate of return of our house style is a little over 20% pa. You can see that in the return profile across different hold periods – the average return across a range of hold periods is pretty consistent at about 20% pa, and as the hold periods get longer the spread of the returns tightens closer around that inherent long-run rate of return.