In part 1 of this piece we outlined that managed funds in New Zealand have to show a standardised risk indicator, which is a number from 1 (low risk) to 7 (high risk), and is calculated from the volatility of the fund’s monthly returns. Now in part 2 we’ll highlight three aspects of why volatility has limitations when evaluating risk.

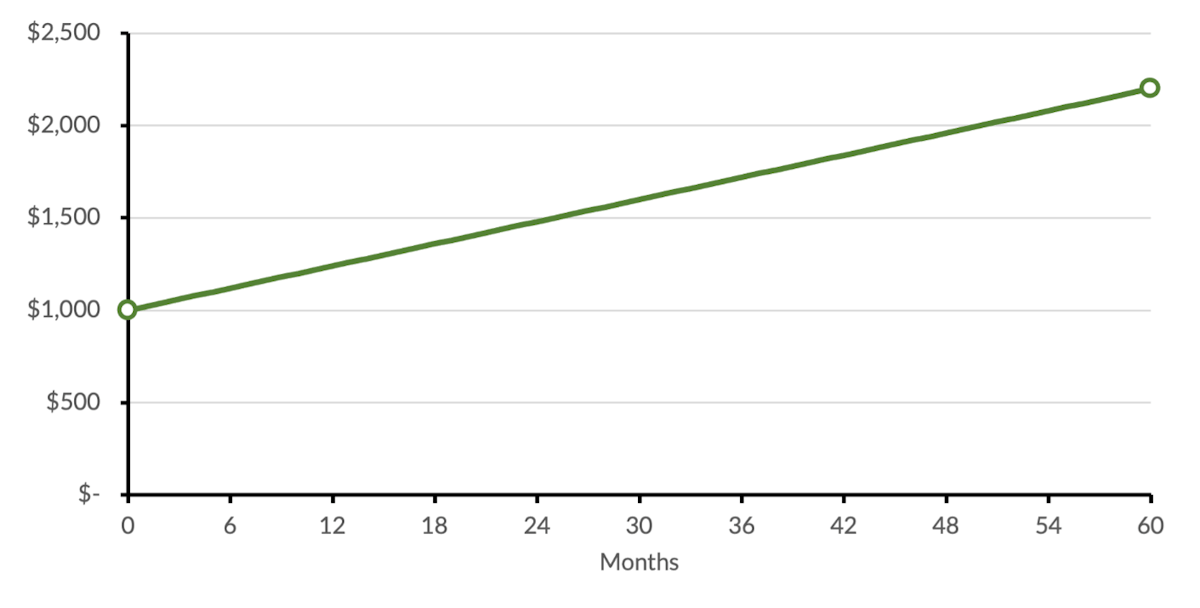

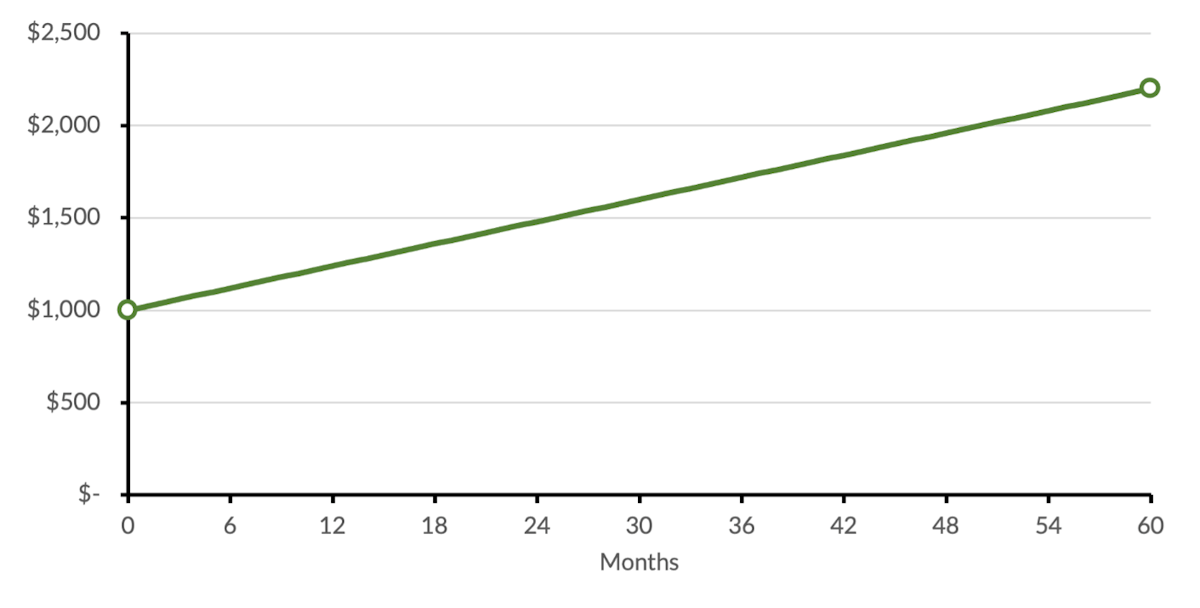

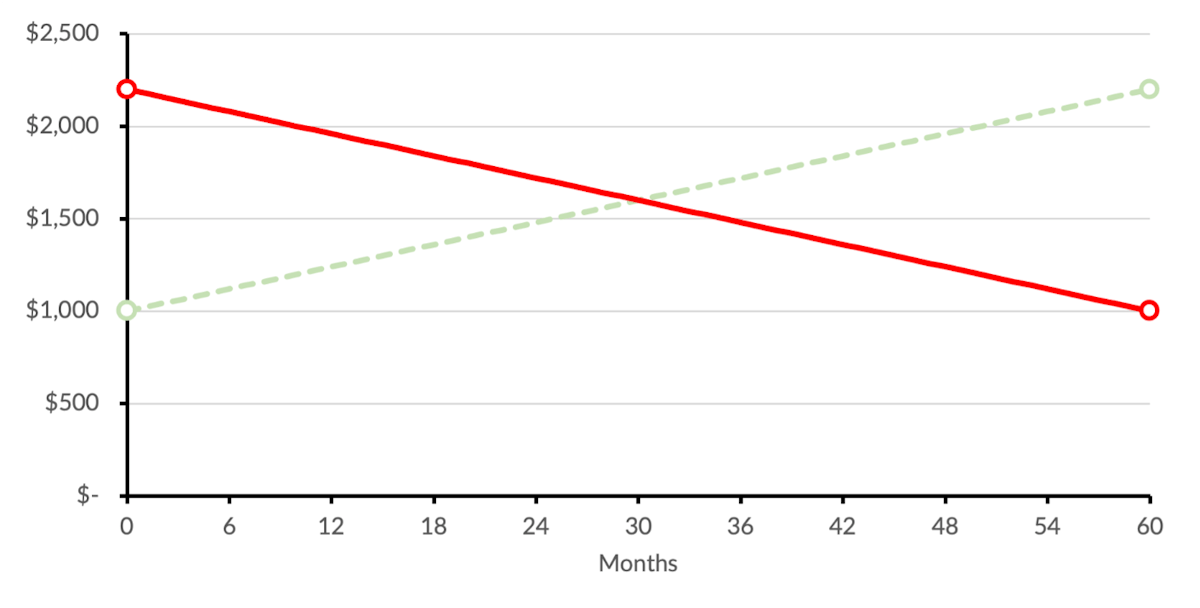

Firstly, volatility calculations are disconnected from whether your investment is increasing or decreasing in value – even though risk is about the possibility of losses. Imagine a $1,000 investment that increases in value by $20 every month. After 5 years you’d have $2,200, and an average return of 17.1% pa. On a chart that looks like this:

Investment one - You receive $20 every month

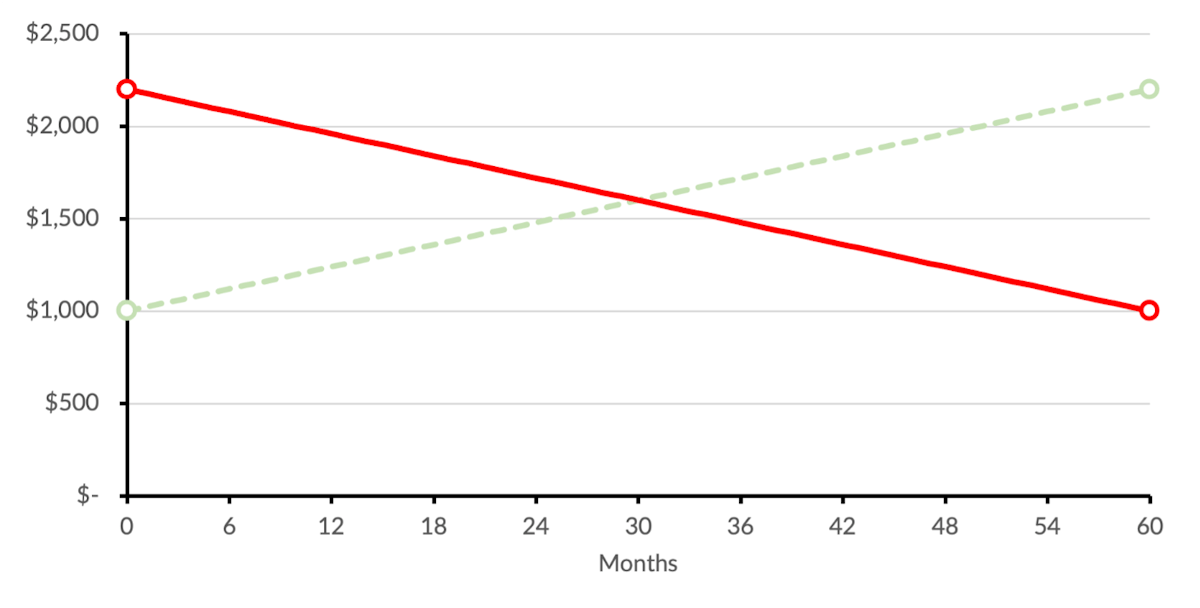

Now imagine you have a second investment, where a $2,200 investment decreases in value by $20 every month. After 5 years you’d have $1,000, and an average return of -14.6% pa. On a chart that looks like this:

Investment two - You lose $20 every month

Here’s the thing … both investments have essentially the same volatility (1.07% for the green line and 1.04% for the red one). So the risk indicator would say these two funds are equally risky, even though that’s not the common sense interpretation.

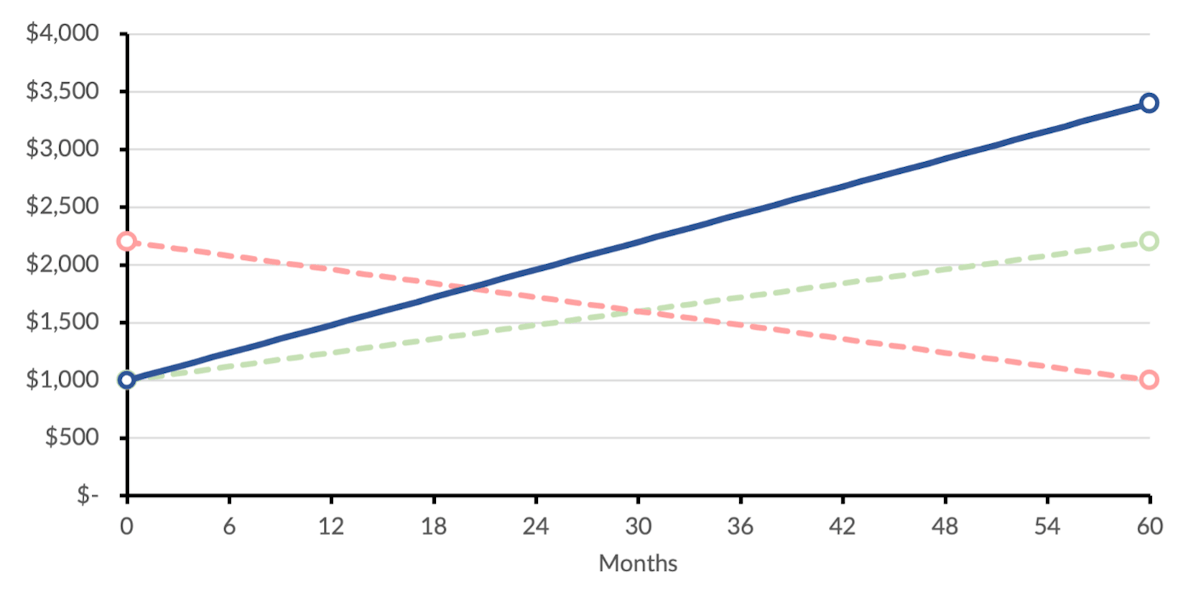

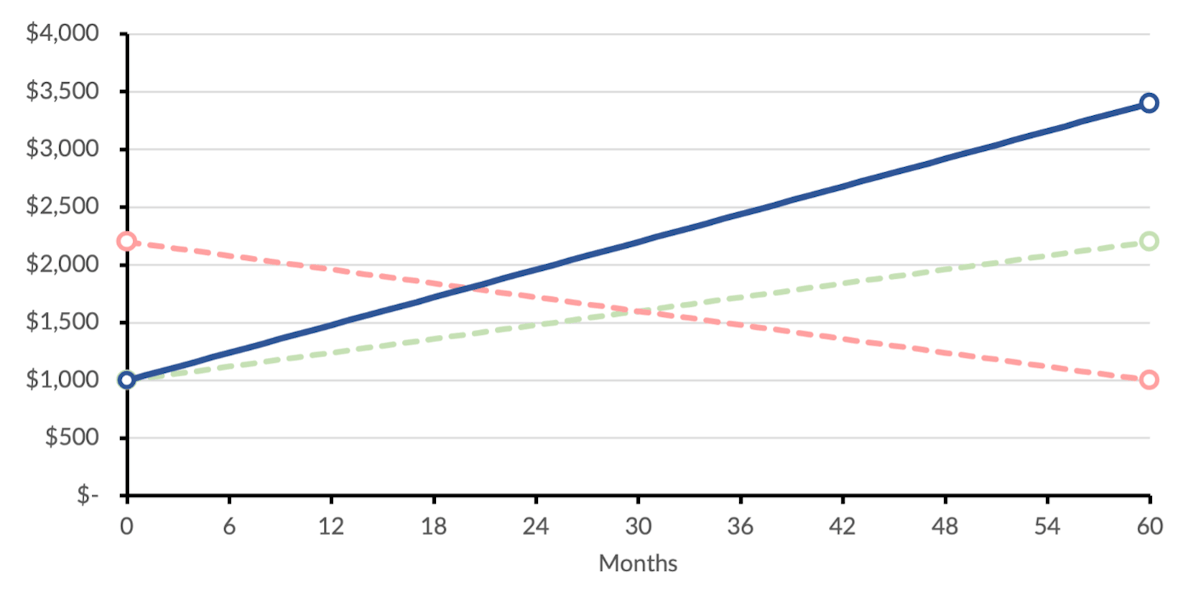

So now imagine you have a third investment. It’s just like the first one, except that it increases in value by $40 every month not $20. After 5 years you’d have $3,400, at an average return of 27.7% pa. On a chart that looks like this:

Investment three - You receive $40 every month

Except … the volatility of this new investment is two-and-a-half times that of our first investment (2.46% for the blue line). So it’s “riskier”. Even though common sense suggests it’s the best investment of the three and that it doesn’t appear to have any higher risk of losses than investment one.

Secondly, investors don’t actually care about a lot of the volatility they experience. No one complains when the value of their investment rises, but that’s volatility. Generally what concerns investors is downside volatility, which is the volatility you experience when prices are falling. There are ways to measure downside risk, such as downside deviation, Sortino Ratios or maximum drawdowns, but those aren’t the calculations the risk indicator is based on.

Thirdly, low volatility is not the same as low risk. At the time of the 2008 Global Financial Crisis many New Zealanders had investments in debt (bonds) or mezzanine securities (such as preference shares) issued by finance companies. In most cases these finance companies continued to meet their scheduled interest or dividend payments right up until the point where the finance company declared insolvency and much or all of the investors’ capital was lost. In risk indicator terms these investments were low volatility, and hence low risk, but clearly that turned out to not be the case. There are many dimensions of risk other than volatility, for example liquidity risk and counter-party risk, but the risk indicator doesn’t capture those.

But that’s enough about the risk indicator. In our next pieces on risk we’ll look at what we think risk really is, and how we track it here at Lighthouse Funds.