The Product Disclosure Statement (PDS) for every managed fund will show a “Minimum suggested investment timeframe” – it’s a statutory requirement for every PDS. In the PDS for the Lighthouse Global Equity Fund we recommend investors have an investment timeframe of 5 years. Firstly, because that’s the investment horizon we try to target with the Fund’s investments and, secondly, because we believe that over that length of time you’ll receive the “true” return for the Fund’s strategy and style.

But how should those investors think about their hold period? We think there are two pragmatic questions that help inform investors’ thinking.

Firstly, How Long Do You Need To Invest For To Avoid The Risk Of Losses?

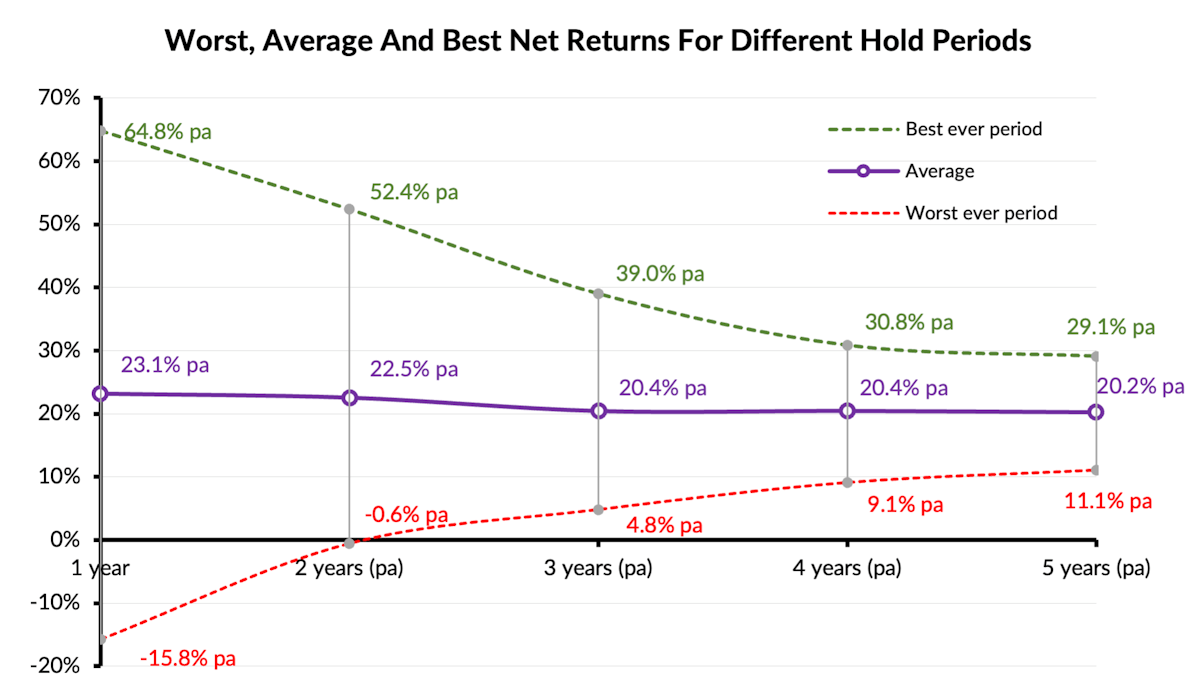

There’s a chart in our earlier piece on “Focusing on what really matters” that highlights an important concept:

Some explanation - this chart shows the worst, average and best returns we've seen across more than nine years of investing using the Fund's investment strategy (1). If you look just at the dashed red line, for the “worst ever period”, you can see the Fund’s worst ever 1 year period was a 15.8% loss, its worst ever 2 year period was a slight loss, but its worst ever 3 year period was still a positive return.

We think investment risk is all about managing, and ideally eliminating, the probability of permanent loss (we’ll write more on this shortly). So this chart says that if your investment horizon in this Fund was to be only 1 year then there is a possibility you'll incur a loss (to be more precise we calculate the possibility of any rolling 1 year period having a negative return at about 14%), if your investment horizon was to be 2 years then there's still a small possibility of permanent loss (so far just one rolling 2-year period across 9 years), but if your investment horizon is longer than 2 years then, at least historically, we've not seen permanent losses.

So based on this information we recommend that the shortest period an investor should consider for an investment in the Lighthouse Global Equity Fund is 3 years, in order to reasonably expect you shouldn't incur a permanent loss on the investment. And on the basis of the analysis outlined here we still feel comfortable recommending investors have a longer 5 year horizon.

Secondly, How Long Do You Need To Invest For To Ensure You Beat The Benchmark Return?

The Lighthouse Global Equity Fund’s benchmark index is the MSCI All Country World Index (ACWI), net in New Zealand dollars. Our objective is not only to beat that benchmark, but to beat it by at least 2% pa.

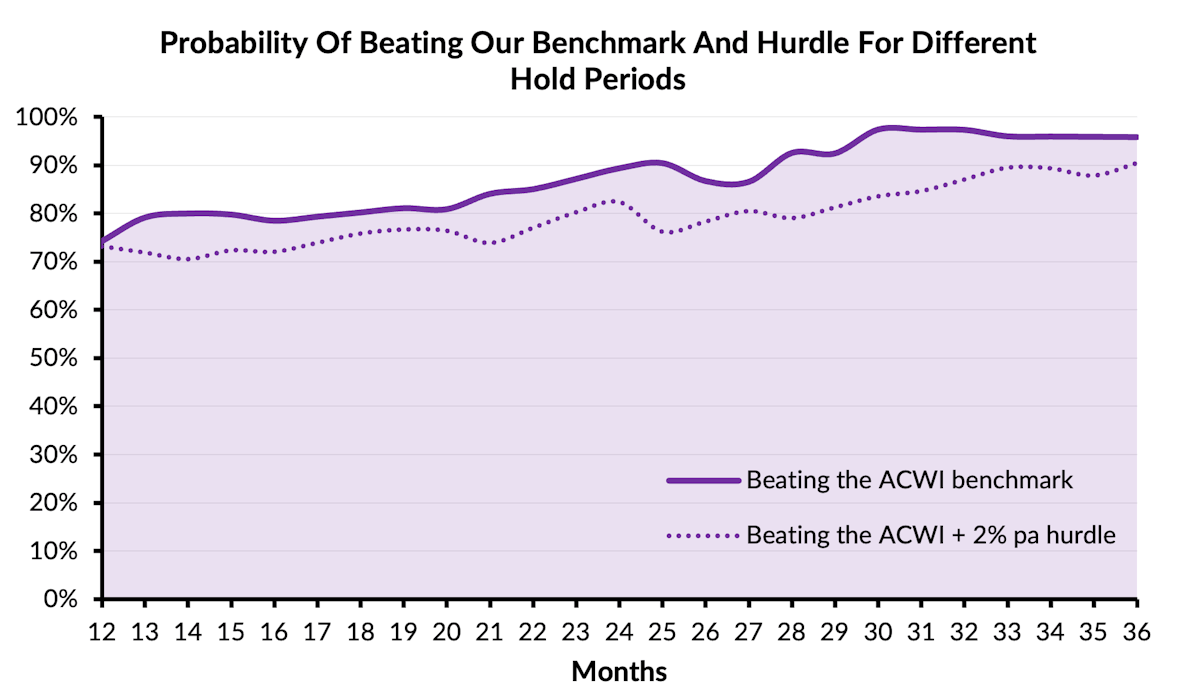

So if we compare the Fund’s returns with those of the ACWI then we see the Fund’s probability of beating the ACWI has been (2):

What this analysis shows is that, historically, as long as your investment timeframe was at least 30 months long then there's been a 95% likelihood you would have received an investment return that was better than the ACWI benchmark’s return.

And, similarly, by the time you get to 36 month hold periods or longer then the Fund is beating our “ACWI + 2% pa” goal more than 90% of the time (eg in more than 90% of the rolling 30 month periods).

But if, for example, your investment timeframe were to be as short as 12 months then the Fund has beaten the ACWI in only 74% of those rolling 12 month periods – which means you would have had about a one-in-four probability of underperforming that ACWI benchmark.

So based on this analysis we'd recommend that investors should consider an investment timeframe of at least 30 months for an investment in the Lighthouse Global Equity Fund, in order to reasonably expect they should receive a return that beats our benchmark index. And we'd feel more comfortable with an even longer hold period in order to increase the probability of the returns exceeding our hurdle. We think that lines up with our recommendation in the previous section that investors have at least a 3 year investment horizon for an investment in this Fund.

Summing It Up

We recommend that when investors are considering investment timeframes – for any investment – they consider the risk of permanent loss and the risk of underperformance. Those two factors are useful guides to how long a commitment you should make in order to ensure short-term volatility doesn’t harm your returns.

For the Lighthouse Global Equity Fund we interpret those two factors as pointing investors towards an investment horizon of at least 3 years, based on the historical experience. We acknowledge there’ll be investors who have good reasons to invest for shorter periods, but we need to point out that the investment risks are higher with those shorter timeframes.

Note that you can do this same analysis for any fund where you can get a long return history (for example, monthly returns for at least five years). Note too that these numbers are as at the end of April 2022 and they may move around a little over time as the Fund and the market go through different periods. But we believe the principles and the approach set out here are a pragmatic way to frame your investment choices.

Footnotes:

(1) This is the nine and a bit years from 31 March 2013 to 30 April 2022. From March 2013 to March 2016 we trialled and proved this strategy using private money. We don't use the results from this period in our marketing because they are unaudited - but we are including them in this analysis here because they include the worst return periods we've seen with this strategy to date and so provide the worst, or most conservative, results in this analysis. Then from March 2016 to March 2021 this strategy was used in a wholesale fund, with audited results. And from March 2022 this strategy is also employed in our retail unit trust PIE, which is also audited.

(2) This analysis draws on the same nine and a bit years of investment returns and ACWI performance from 31 March 2013 to 30 April 2022. Again we are including our trial and test period because that captures the worst period of results for the Fund's investment strategy and provides the worst case results in this analysis.